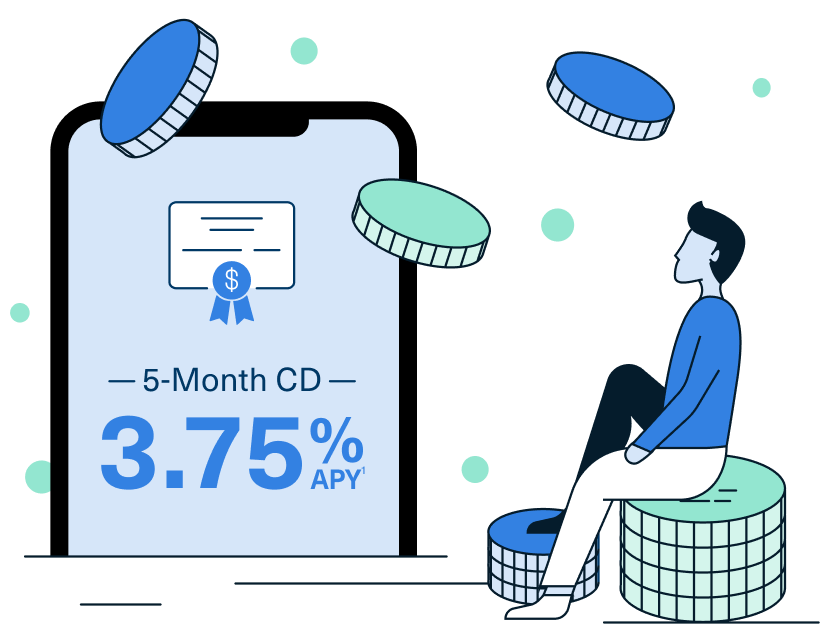

Special Offer: 5-Month CD at 3.75% APY1

Make meaningful progress toward your goals with a highly competitive short-term return. Minimum $1,000 to open.

Make meaningful progress toward your goals with a highly competitive short-term return. Minimum $1,000 to open.

Explore CU1 auto loans with a variety of financing terms that fit your needs, no matter your budget. Apply for preapproval online in minutes.

CU1’s new No Down Payment mortgages6 can help you achieve home ownership with fewer upfront costs. Take the next step of building equity by owning your home without depleting your savings.

Good financial health is a journey, with lots of learning along the way. Whether you are signing up for your first checking account or planning for retirement, Credit Union 1 wants to pass along your knowledge. Because our first love is banking, and our first priority is helping you achieve your goals.

When it comes to managing your finances, there are options beyond traditional banks—credit unions. Credit unions are financial institutions that offer similar services but operate differently than banks.

Read More

Auto refinancing can be a savvy financial move for car owners who want to save money on their auto loan. Whether you're looking to lower your monthly payments, reduce the amount of interest you pay over the life of the loan, or simply find better member service with a new lender, refinancing your auto loan can help you achieve your goals. In this day and age, every penny counts, and auto refinancing is just one way to put a little extra cash back in your pocket.

Read More

Your home is an asset, and its value can help you reach other financial goals sooner. A Home Equity Line of Credit (HELOC) and a Home Equity Loan (HELOAN) are both forms of borrowing that use the equity in your home as collateral.

Read MoreYou are leaving creditunion1.org and entering a website that Credit Union 1 does not control. Credit Union 1 has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of or the propriety of any information on this website. Do you want to proceed?

Yes No