Credit Score

Take control of your credit with free tools in Digital Banking.

When it comes to your credit, knowledge is power. Credit Score is available for free to all CU1 members through Digital Banking, and it is more than just a way to track your score—it offers resources and tools to help you understand what your score means and how you can take the right steps to improve or maintain it.

Through Credit Score, you have access to:

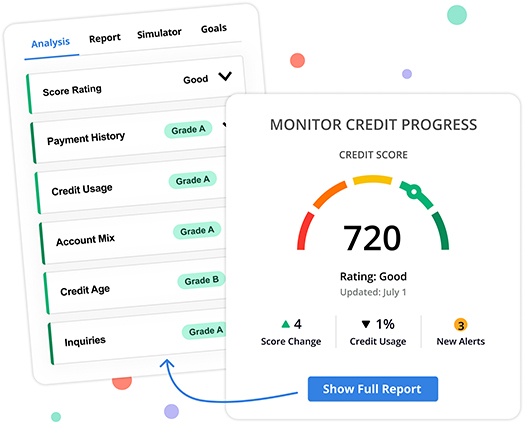

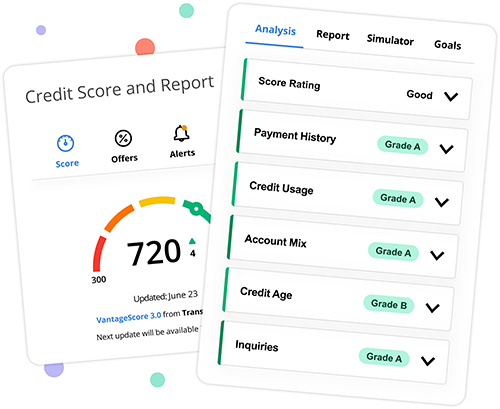

- Your full Credit Score Analysis, including Credit Score Rating, Payment History, Credit Usage, and more

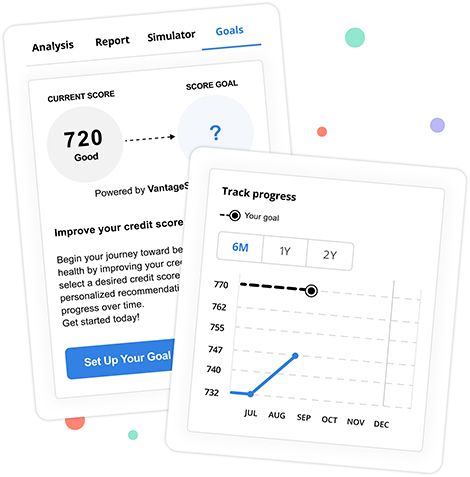

- Credit Score Goals, which allows you to set and track credit improvement goals

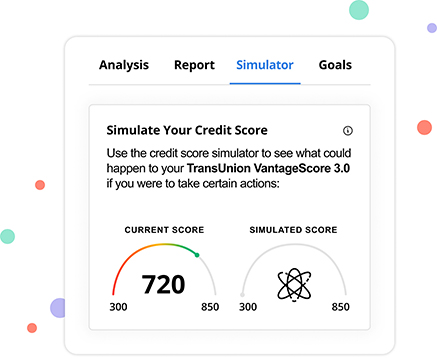

- The Score Simulator, which helps you see how certain actions impact your credit score

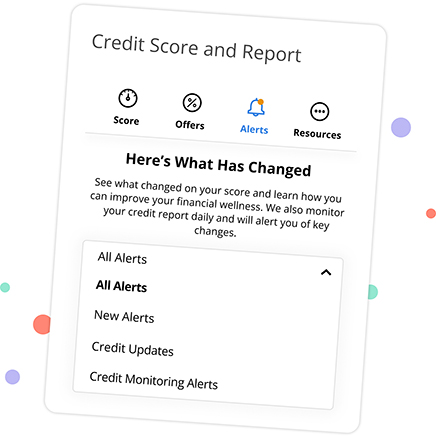

- Credit Score Alerts, including credit monitoring alerts, credit updates, and more

Using the Credit Score tools has no impact on your score, and it is simple to get started. Log in to Digital Banking and access Credit Score through your personalized dashboard.

Not registered for Digital Banking? Register Now.