Access Your Auto Loan

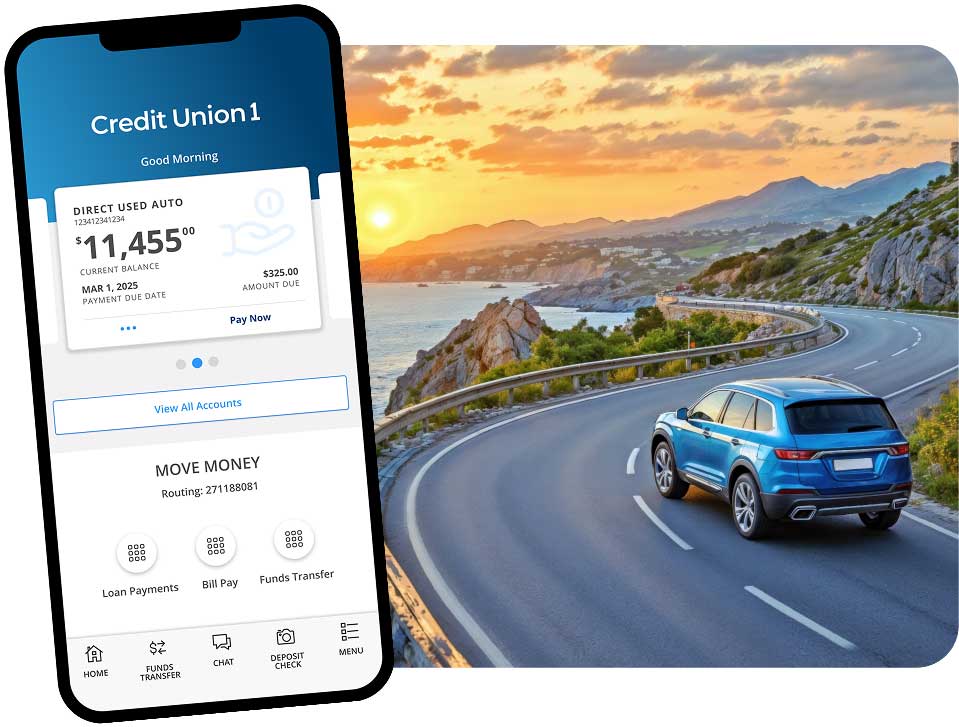

Make loan payments and view your loan details through CU1's Digital and Mobile Banking. You can access your loan immediately once you register.

Register for Digital Banking now.

Download the CU1 Mobile Banking App

Welcome to Credit Union 1! Through your new auto loan, you now have access to the full benefits of membership with CU1, including 24/7 account access through Digital and Mobile Banking, competitive lending rates, first-class checking and savings products, personalized member service, and tailored financial education resources. CU1 is committed to being your financial partner and making managing your loan a seamless, easy experience.

Learn more about your auto loan:

Credit Union 1 is seriously the best... Their online and mobile banking options are a breeze to use, and I love that I can check my accounts and make transactions whenever, wherever.

Make loan payments and view your loan details through CU1's Digital and Mobile Banking. You can access your loan immediately once you register.

Register for Digital Banking now.

Download the CU1 Mobile Banking App

Contact your insurance company to list Credit Union 1 (P.O. Box 2200, Carmel, IN 46082) as the lien holder. You will also need to submit proof of insurance with our partner MyInsuranceInfo and ensure your insurance meets Credit Union 1's requirements.

Credit Union 1 Auto Insurance Requirements:

If your auto insurance policy does not meet our requirements listed above, you will receive a phone call, email, or text communication from Allied Solutions, a company providing insurance policy tracking for Credit Union 1.

Please contact Allied Solutions directly at (800) 653-8812 with any questions.

Make a Payment

You can make a loan payment with your CU1 Checking or Savings account directly through Digital and Mobile Banking.

You can make a loan payment with an account or debit card from another financial institution within CU1 Digital Banking. You will need to link your external account within CU1 Digital Banking to set up your first payment.

Looking for other ways to pay your loan? View All Payment Options

Log in to Digital Banking and start a secure chat with our Member Solutions team during business hours, or send a secure message at any time. You can also speak to a Member Solutions Specialist on the phone by calling (800) 252-6950 and saying "Manage my auto loan" when prompted by Luna, CU1's Virtual Assistant. Our Member Solutions Specialists are available Monday through Friday, from 8am to 6pm CT.

Protect the ones who matter most with financial protection for the unexpected. CU1 Debt Protection with Life Plus could help your family’s financial situation against a variety of covered life events.

Guaranteed Asset Protection (GAP) protects your finances if the value of your vehicle is less than the amount of your car loan.

Mechanical Repair Coverage can help deflect some of the risks of future costly repairs, keeping your vehicle running for extra miles and years.

Receive affordable top-quality protection and enjoy discounted rates combined with online convenience and 24/7 claims service.

Good financial health is a journey, with lots of learning along the way. Whether you are signing up for your first checking account or planning for retirement, Credit Union 1 wants to pass along our knowledge. Because our first love is banking, and our first priority is helping you achieve your goals.

Paying your debt off early means less stress and more money that you can put toward your other financial goals. While delaying repayment for another day is tempting—especially when you have other financial commitments—tackling your debt sooner rather than later will save you money in the long run.

Read More

If you have an auto loan and want to save money, consider refinancing. Loan refinance is when an existing loan is given new terms and conditions that are better suited to your needs, with either your current lender or a new one.

Read More

Most people use a checking account to manage their everyday finances—to pay bills, receive a direct deposit paycheck, make purchases, and more. But certain types of checking accounts, known as high yield checking accounts, can also help you save money.

Read MoreYou are leaving creditunion1.org and entering a website that Credit Union 1 does not control. Credit Union 1 has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of or the propriety of any information on this website. Do you want to proceed?

Yes No