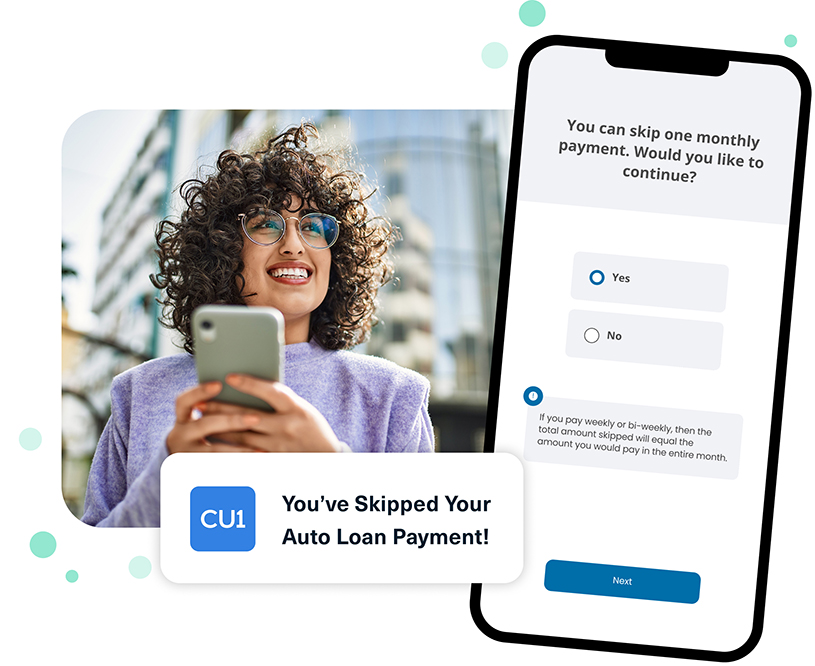

Skip-a-Pay

Skip up to two loan payments right now.

Could your budget use a break from your loan payment? As a valued CU1 member, you may be eligible to skip a loan payment, freeing up cash when you need it. You can skip up to two payments per eligible loan each rolling 12 months, with no negative impact on your credit.

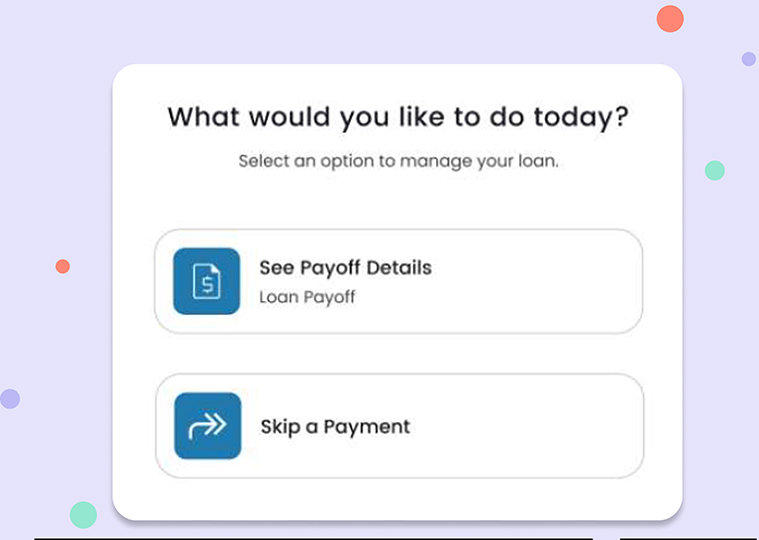

Submit a request to skip your next payment on qualifying Credit Union 1 loans through the CU1 Skip-a-Pay1 program. Simply log in to Digital Banking to submit your request in minutes.

Let CU1 give you flexibility for your finances with Skip-a-Pay1.

Not registered for Digital Banking? Register Now