Special Offer: 5-Month CD at 3.75% APY

Steady progress makes long-term savings goals more attainable. For a limited time, lock in 3.75% APY1 on a 5-month CD—one of our strongest savings rates, without a long wait for your CD to mature. Minimum $1,000 to open.

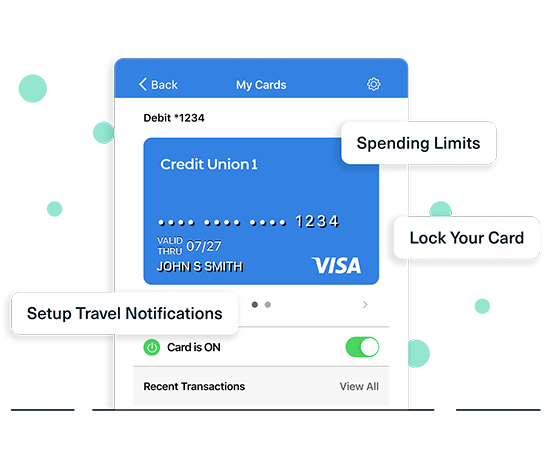

Visa® Zero+ Credit Card

Get a special low 0% introductory APR* for 24 billing cycles on purchases and balance transfers when you apply for a Visa Zero+ Card by March 31, 2026.

Business Zero+ Credit Card

Power your business with a 0% introductory APR* for 18 billing cycles on purchases and balance transfers when you apply for a Business Zero+ Card.

Auto Loan Rates as Low as 4.99% APR³

Whether you are shopping for a new or used vehicle, or looking to refinance your current auto loan, CU1 has competitive financing options on a variety of terms.

Book Your Next Trip with HELOAN Funds

With a fixed-rate home equity4 loan (HELOAN), you can turn the equity in your home into funds for your dream vacation! CU1 currently has one of the most competitive HELOAN rates on the market—lock it in today and start booking your next adventure.

Open the Door to Your Home with 0% Down

CU1’s new No Down Payment mortgages5 can help you achieve home ownership with fewer upfront costs. Take the next step of building equity by owning your home without depleting your savings.

CU1 x Cole Kmet

Credit Union 1 is teaming up with Chicago tight end Cole Kmet to make an impact in our communities. Kmet has deep roots in both Chicago and South Bend, and we will partner together to give back and make an impact.