Updated as of | Merger Completion Tracker: 100%

Welcome to CU1

As a member of Credit Union 1 (CU1), you have access to a wide variety of products and services, and we are pleased to have the opportunity to help you meet your financial goals.

How are we doing? Provide Feedback

High-Priority Items

-

Update Account and Routing Number

If you have any automatic debits or credits to your Heights Auto Workers CU account, you will need to advise each business of your new Credit Union 1 account number and CU1’s Routing & Transit #: 271188081.

To find your account number in Digital Banking, log in, select the account tile, and use the number at the top—excluding the last four digits.

-

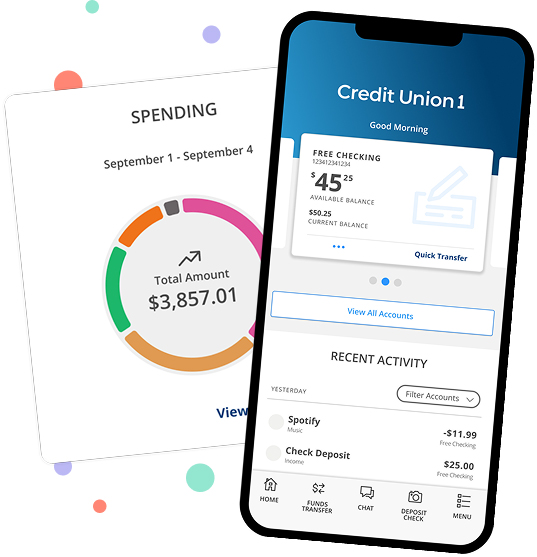

Register for Digital Banking

CU1's Digital and Mobile Banking is a seamless way to manage your accounts on your schedule. Pay bills, send money, track spending, manage your debit cards, monitor your credit, and more in Digital Banking. Register Here.

Watch a How-To video that details the steps to enroll in Digital Banking.

-

Enroll in eDocuments to Receive eStatements

Paper statement fees will be waived through May 31, 2026. If you are not enrolled in eDocuments after this date, you will be charged a $5.00 monthly statement fee. Set up eStatements by enrolling in eDocuments through Digital Banking.

Follow these step-by-step instructions to learn how to enroll in eDocuments.

-

Verify Payroll

Every effort was made to ensure payroll deposits and payroll distributions were converted properly. While there was no action required on your part for this transition, we recommend that you verify your payroll deposit and/or payroll distribution through Digital Banking with your first payroll.

Activate your CU1 Debit Card

CU1 debit cards can be easily activated through Digital Banking. Simply log in and navigate to Debit Card Controls under the main Services menu. Or you can call 800.992.3808 to active in a few simple steps.

Consumer Loans

Members who have a mortgage, home equity loan, or auto loan were converted to a matching or similar product in the CU1 system. The rate and term for each of these products will remain the same as originally contracted for the remaining term of the agreement.

Payment Changes

Several types of automatic payments—including internal transfers, recurring payments set up in Digital Banking, and external bill pay—did not carry over with the conversion. You will need to set up these payments again within CU1 Digital Banking.

If your loan payment was set up as an ACH (or a payment that makes a direct withdrawal from your bank account using your account number and routing number), any existing loan payments will clear. CU1 will do our best to clear transactions that use your HAWCU account and routing number for up to six months. However, your HAWCU account and routing number will no longer be valid after six months, and we recommend proactively updating everything to your new CU1 account and routing number as soon as possible to avoid the need for future changes.

Credit Cards

To manage your Heights Auto Workers credit card and make all future payments, you will continue to use the eZCard Credit Card Portal.

Customer Service: (888) 406-7409

Changes Coming Soon

May 31, 2026

- Savings Only and Inactive Account fees waived until May 31.

August 31, 2026

- Heights Auto CU’s Routing Number will deactivate on August 31.

Get the Most Out of Your CU1 Account

Now that the conversion is complete, you can take advantage of the features Credit Union 1 offers to make everyday banking simple and convenient. Learn more about these key features and how you can easily set them up today.

Branch Information & Hours

Beginning March 2, members have access to more branches in the Chicago area. Visit any Credit Union 1 branch for your banking needs.

Burnham

13912 S. Torrence Avenue

Burnham, IL 60633

New Branch Hours:

Monday: 9:00am - 6:00pm

Tuesday: 9:00am - 6:00pm

Wednesday: 10:00am - 6:00pm

Thursday: 9:00am - 6:00pm

Friday: 9:00am - 6:00pm

Saturday: Closed

Sunday: Closed

East Side

11615 S. Avenue O

Chicago, IL 60617

New Branch Hours:

Monday: 9:00am - 5:00pm

Tuesday: 9:00am - 5:00pm

Wednesday: 10:00am - 5:00pm

Thursday: 9:00am - 5:00pm

Friday: 9:00am - 5:00pm

Saturday: Closed

Sunday: Closed

Evergreen Park

9441 S. Kedzie Avenue

Evergreen Park, IL 60805

New Branch Hours:

Monday: 9:00am - 6:00pm

Tuesday: 9:00am - 6:00pm

Wednesday: 10:00am - 6:00pm

Thursday: 9:00am - 6:00pm

Friday: 9:00am - 6:00pm

Saturday: 9:00am - 12:00pm

Sunday: Closed