Updated as of

A Partnership with Spirit Financial and CU1

Benefits for Members

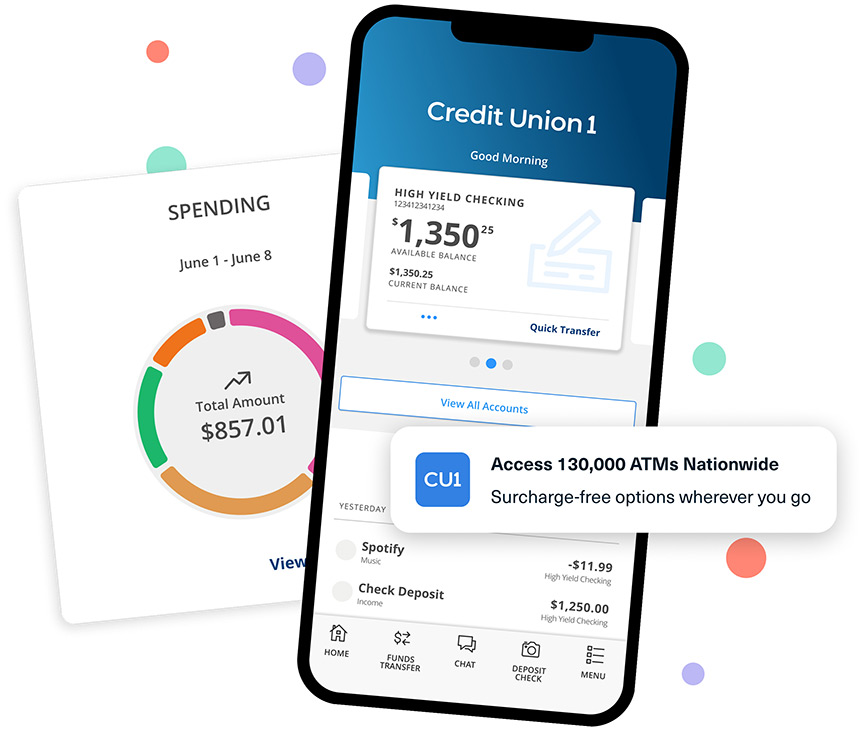

This merger will ensure that Spirit Financial CU members have access to the quality products and services needed to succeed financially. Credit Union 1 (CU1) offers modern technology, dedication to member service, and competitive everyday banking products that will help members reach their unique financial goals.

More Ways to Reach Your Goals

- Additional products and services—like High Yield Checking1, High Yield Savings2, Credit Cards, special CDs with competitive rates, Business Banking, Business Loans, and Merchant Services—available to members.

- Access to 5,000+ shared branch locations and 130,000 surcharge-free ATMs across the country through the Allpoint, CO-OP, and MoneyPass Networks.

- Enjoy 24/7 support from Luna, our AI-powered Virtual Assistant, or speak to a team member during operating hours.

- Ability to skip loan payments in times of financial hardship.

Proposed Merger Updates

Sprit Financial Credit Union Board of Directors recommend a merger with Credit Union 1 (CU1). Thank you for taking the time to learn more about CU1 and what we can offer you as potential future members.

At this time, no changes will be made to your accounts or the methods you use to access your accounts. If the merger is approved by the membership, a conversion and consolidation of Sprit Financial’s and CU1’s core processing systems will take place. Prior to that date, Credit Union 1 will continue to update this landing page with the most relevant information for the conversion process. Please bookmark this landing page to stay up-to-date on how this merger will affect your membership and access to your accounts.

Upcoming Special Meeting

All Spirit Financial CU members will have the opportunity to vote on the merger at a Special Meeting, scheduled to be held December 22, 2025, with the proposed legal merger date of January 31, 2026.

Important Dates

- Special Meeting: December 22, 2025

- Proposed Legal Merge Date: January 31, 2026

- Proposed System Conversion Date: June 1, 2026

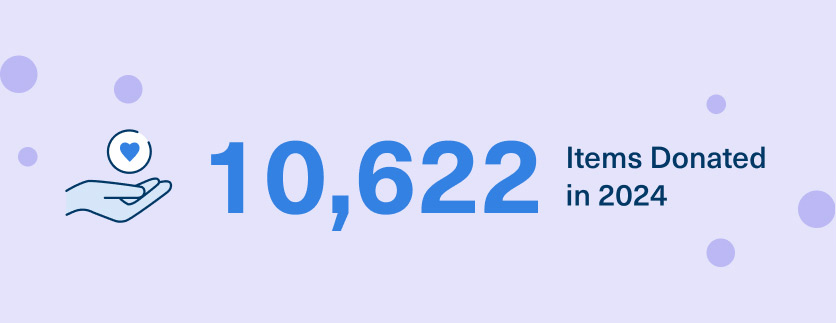

CU1 Gives Back to Our Communities

CU1’s Commitment to Community

Credit Union 1 is committed to strengthening and empowering the communities it serves through CU1 Cares. This initiative supports individuals, families, and local organizations through charitable giving, volunteerism, and financial education. In 2024, CU1 contributed to nonprofits nationwide, collected thousands of items for community drives, and actively participated in local events.

CU1 Community Events

Each month, we share the ways our Credit Union 1 team members have served our communities, through financial literacy events, volunteerism, and donations. We love to see our team members in action and share their positive impact with the CU1 community as a whole.

Merger FAQs for Spirit Financial Credit Union Members

-

Spirit Financial CU wants to bring their members the best value as a primary financial institution and provide the necessary products and services to help you reach your financial goals. Credit Union 1 offers the technology and systems that address their members’ needs. Additionally, CU1’s strong core values give the Spirit Financial CU leadership team and board of directors confidence that their membership will experience a level of quality of service comparable to which you have known. Our credit unions are like-minded, and we strongly believe that a partnership will benefit members and employees of both institutions.

-

Credit Union 1 has more than sixty years of experience helping families and communities reach their economic potential. And we have our eye on the next sixty years, as we continue to evolve and innovate to find new ways to offer our members high-quality, low-cost financial products and services and a modern banking experience.

CU1 was founded in 1958 with an original base membership of personnel from Chanute Air Force Base in Rantoul, Illinois. We have since grown into a billion-dollar-plus financial institution, but our priorities remain the same—helping families and communities succeed financially.

To learn more about what drives us and our commitment to diversity and inclusion, visit our About Us page.

-

Our regulators, the National Credit Union Administration (NCUA) and Illinois Department of Financial and Professional Regulation (IDFPR), have both approved our merger plans. With member support of the merger through the voting process, we anticipate that our first legal day as a combined organization will be January 31, 2026.

-

A merger will provide the resources to better serve your financial needs through industry-leading technology, new products and services, and highly competitive rates. We want to be your first choice for a primary financial institution. Nothing will change until member approval is received. This partnership will mean we can better anticipate and meet all your financial needs. Spirit Financial CU members will now have access to:

- High Yield Checking

- High Yield Savings

- A Full Suite of Business Banking Options

- Broader Selection of Credit Cards

- Financial Wellbeing & Education

- Greater Investment into the Branch Communities

- And much more.

-

Your accounts will continue to be federally insured just as they are today through the National Credit Union Share Insurance Fund, which is backed by the full faith and credit of the U.S. Government and managed by the National Credit Union Administration (NCUA).

-

One reason our two credit unions are pursuing this merger is because we feel both credit unions are like-minded, and we strongly believe that a partnership will benefit members and employees of both institutions. Credit Union 1 strives to provide premium service and you will continue to receive personalized service as you do today.

-

Spirit Financial CU’s field of membership will be incorporated with Credit Union 1’s field of membership after the proposed system conversion date of June 1, 2026.

-

Once member approval is received to merge with Credit Union 1, it has been proposed to keep the Spirit Financial CU branch in Levittown, PA open. Credit Union 1 has 36 branches in Illinois, Indiana, Nevada, Georgia, Florida, Michigan, Wisconsin, Minnesota and North Dakota. In addition to CU1’s branches, members will also have access to CU1’s robust Digital Banking platform, along with access to the CO-OP shared branch and surcharge-free ATM network and the surcharge-free Allpoint ATM network.

-

You can continue to use Spirit Financial CU’s branches. We cannot begin integrating the operations of the two credit unions until after the proposed system conversion date of June 1, 2026. Spirit Financial CU’s members will be notified as soon as the additional branches are connected.

-

Credit Union 1 ATMs are available for anyone to use; however, we cannot begin integrating the operations of the two credit unions until after the proposed system conversion date of June 1, 2026, so you may incur a fee until that time. Once the merger is effective, you will have access to all Credit Union 1 ATMs at no charge along with more than 130,000 surcharge-free ATMs nationwide.

-

Your account number will remain the same for the time being. More information will be provided after the proposed system conversion date of June 1, 2026.

-

Your routing number will remain the same for the time being. More information will be provided after the proposed system conversion date of June 1, 2026.

-

You will continue to use Spirit Financial CU’s online/mobile banking until the proposed system conversion date June 1, 2026. Once the conversion of systems occurs, you will then use Credit Union 1’s Digital Banking platform and highly rated mobile app. Banking anytime, anywhere has never been simpler.

-

You will continue to use Spirit Financial CU’s debit card. Spirit Financial CU members will be issued a Credit Union 1 Visa® Debit Card to use once the conversion of systems occurs.

-

You will continue to use Spirit Financial CU’s account information until the proposed system conversion date June 1, 2026. Once the conversion of systems occurs, you will need to notify each business of your new Credit Union 1 account number and Credit Union 1’s routing and transit number.

-

Until the proposed system conversion date June 1, 2026, none of your account terms will change. Whether or not they will change after the proposed system conversion date depends on the type of account.

Loans | Your existing loan contract will remain in effect until the loan is paid off.

Share Certificates | The terms of your existing share certificate will remain in effect until the maturity date.

Savings & Checking | Rates and terms on these accounts are subject to change at the time of the merger date. You will receive a CU1 Membership Agreement and Account Disclosures before the merger date.

Credit Cards | Credit Union 1 offers an array of credit card options with competitive rates and exciting rewards. More information will be provided after the system conversion date of June 1, 2026.

-

Don’t hesitate to call (267) 580-0230 or email memberservice@spiritfinancialcu.org to contact Spirit Financial CU.