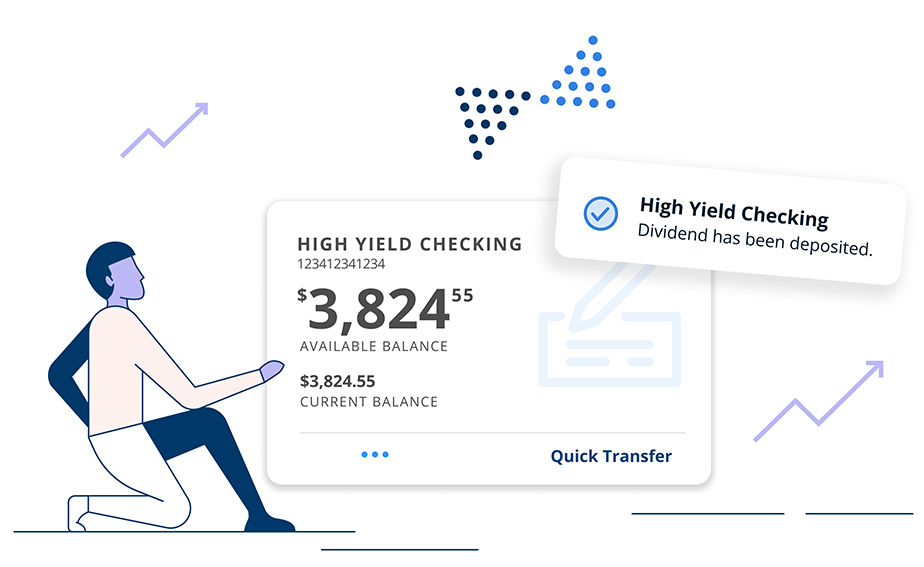

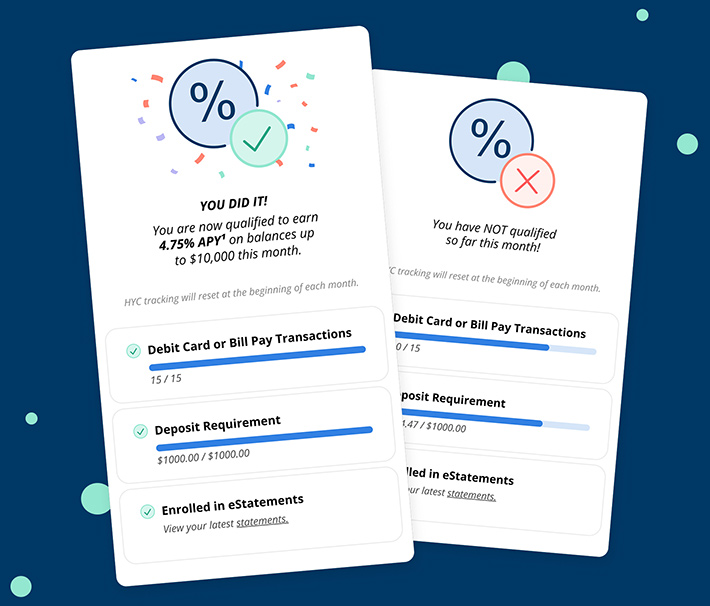

High Yield Checking Earn 4.75% APY

A checking account that rewards you for everyday banking. Earn 4.75% APY1 on balances up to $10,000 when you make qualifying transactions each month.

- No monthly fees or minimum balances

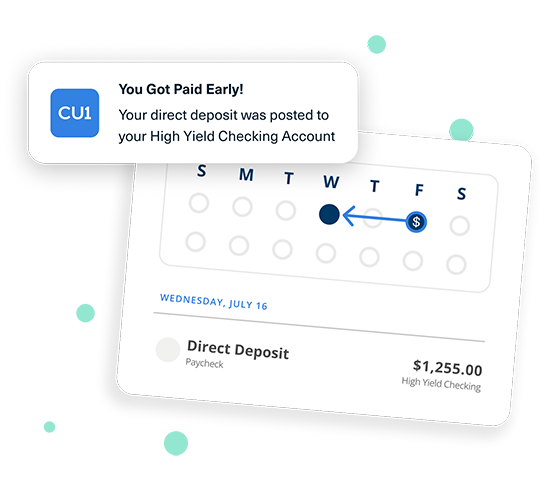

- Get paid up to two days sooner2 with direct deposit

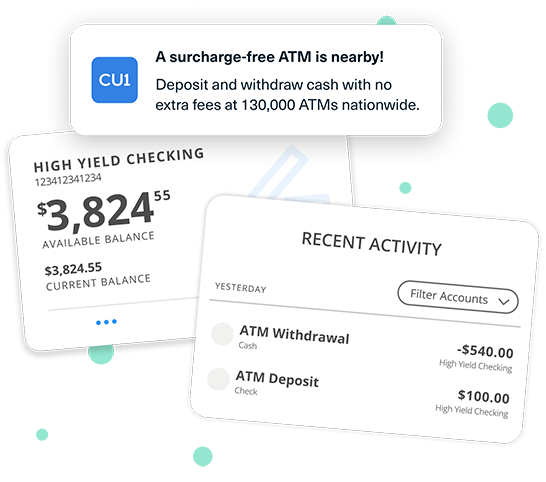

- Access 130,000 surcharge-free ATMs nationwide

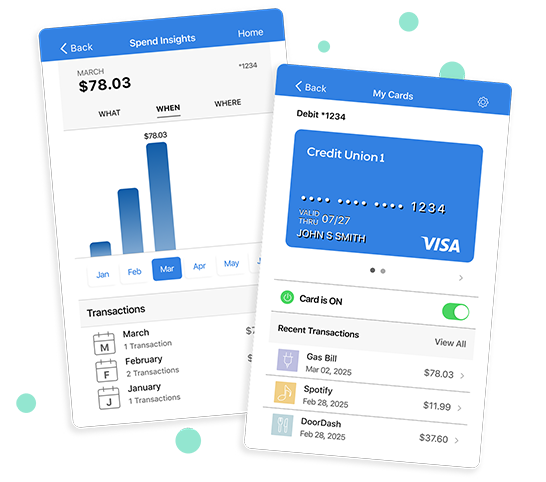

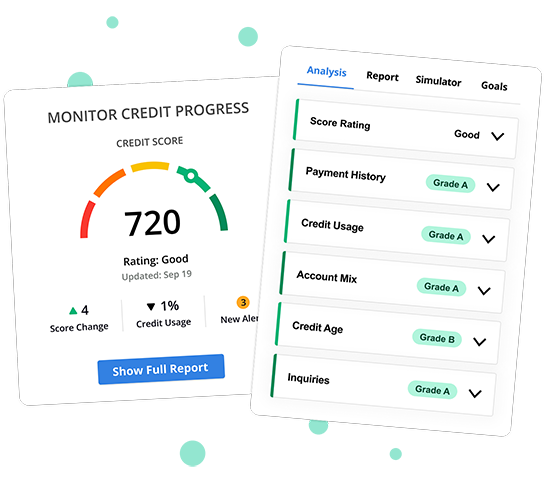

- Digital and Mobile Banking that helps you spend securely, budget better, and stay on top of your finances