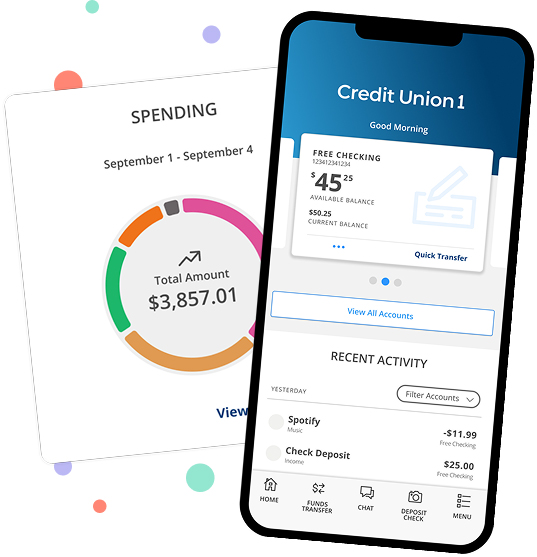

Action Needed: Quicken and QuickBooks Update

The system conversion from Great River FCU to CU1’s system on October 1, 2025, will require that you make changes to your QuickBooks or Quicken software, so please take action to ensure a smooth transition.

On or After October 2, 2025

- Complete the remaining steps in the conversion instructions listed below. Complete the deactivate/reactivate of your digital banking connection.

- New Users can get started by clicking here.

Conversion Instructions