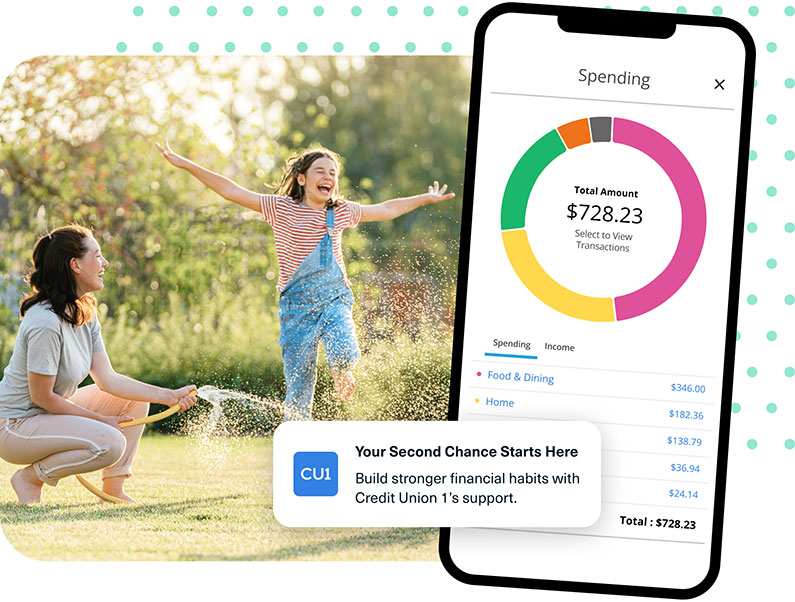

Second Chance Checking Build Better Money Habits with CU1

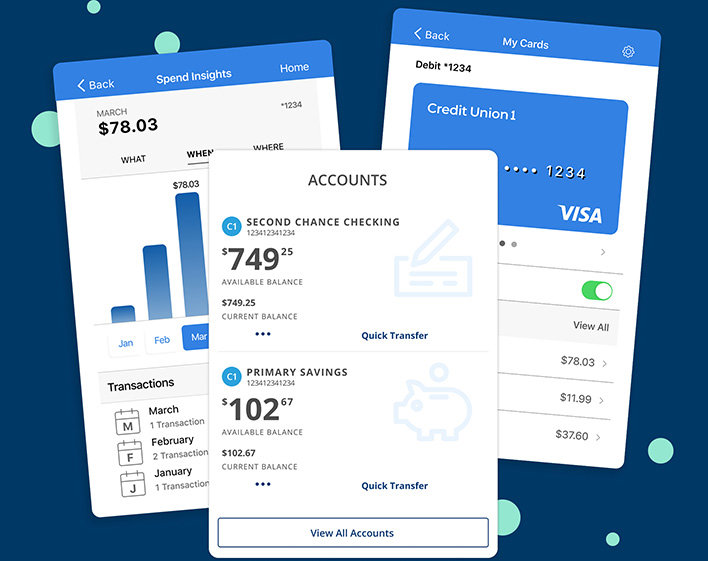

Bounce back stronger than ever with CU1 Second Chance Checking1, which offers you another shot to get your finances on track. There are no monthly fees and no minimum balance requirements. Plus, with Second Chance Checking1, you get:

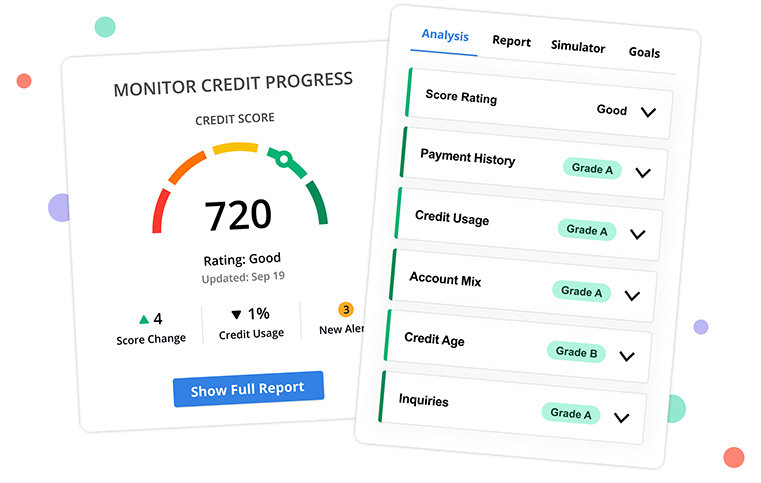

- Free access to your credit score and tools to improve credit in Digital Banking

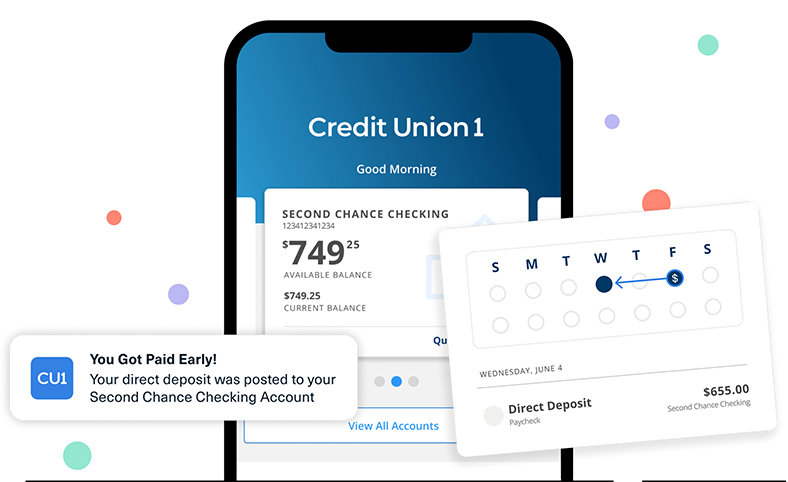

- The chance to get paid up to two days sooner2 with direct deposit

- Free financial education resources to improve your financial position.

When you successfully manage your account for 6 months, you will become eligible to upgrade to a Free Checking3 or High Yield Checking4 account, which include additional features like Zelle®, External Transfers, higher mobile check deposit limits, and more.

Get Started Learn How to Manage a Second Chance Checking Account