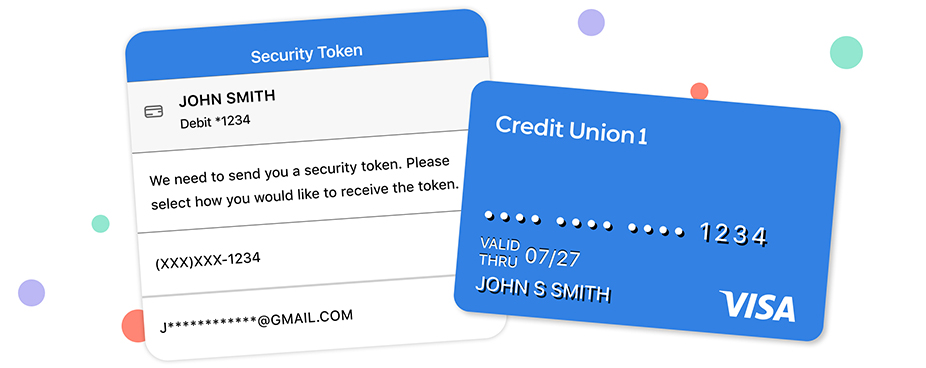

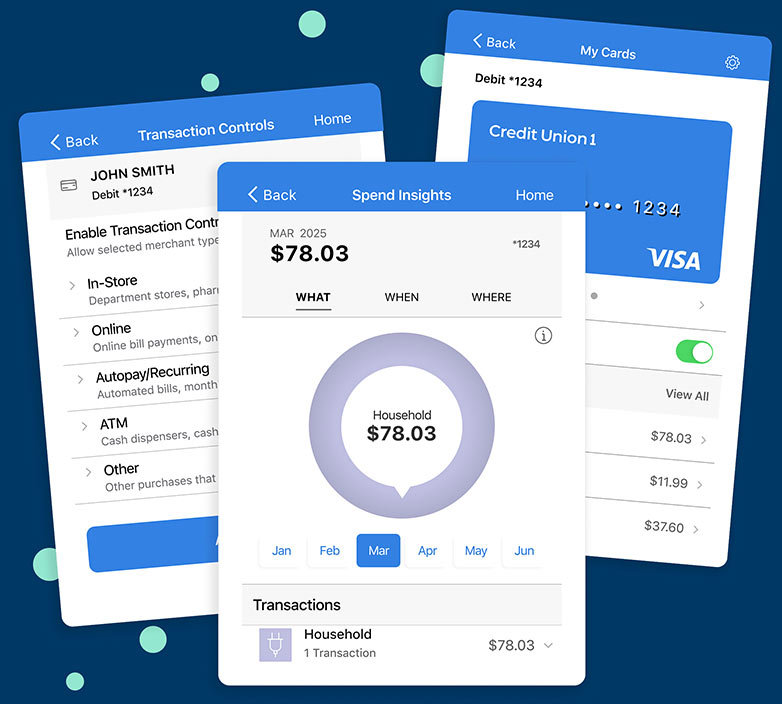

Instantly Access Your Temporary Debit Card

When you open a new CU1 checking account or order a new debit card, you can immediately access your money with CU1's temporary digital debit cards. It's your money--CU1 makes sure you have access to it right away.