Online Bill Pay makes paying your bills more convenient. All of your billers are kept in one place, no need to log on to multiple biller sites and services. Bills can even be delivered directly to your Online Bill Pay account electronically. Paying your bills is also more convenient with options to schedule payments, to pay bills when they arrive or to hand pay bills on your schedule.

back to top

Nothing. That's right it's free. All you need is a Credit Union 1 Checking Account and access to Online Banking and you can begin paying your bills for free today.

back to top

The Online Bill Pay application can be accessed in Online Banking on the Account Summary screen under Bill Payment. Select Enrollment Options and follow the prompts to sign up.

back to top

You will need a Credit Union 1 checking account and access to Online Banking. To get started gather any copies of bills you wish to pay online. You will need the biller's name, address and your account number with the biller. Many of the companies you pay are already in Online Bill Pay so you will only need to select them from the list and put in your account specific company information. Many billers can also send e-bills directly to your Online Bill Pay account where they can be paid automatically or on demand depending on your preference.

back to top

The answer is some of both. Most payments will be electronic but some billers are still unable to accept electronic payments. In those cases a paper check will be sent. Online Bill Pay can pay bills in three ways:

- Via electronic transmission from Online Bill Pay to the Biller.

- Via check drawn on your personal checking account.

- Via a check drawn off of an account from Online Bill Pay.

back to top

An e-bill is a copy of your bill and the information in it that is sent to your Online Bill Pay account rather than to you in the mail. These bills are kept safely on Online Banking and can be paid automatically or on demand depending on your preference.

back to top

Yes, you can download bill payment history as a .csv (comma separated) file for use in programs like Microsoft Excel. Direct download to Quicken or other personal finance software is not available.

back to top

You can pay anyone from your power company to your paper boy. Online Bill Pay is flexible and payments are sent in the way that billers can process them. You can even make person-to-person payments using Popmoney®.

back to top

Yes, we use industry standard encryption and security measures during the logon and authentication process and during your bill pay session.

back to top

First, don't worry we all make mistakes. Online Bill Pay is flexible and understands these situations. You may cancel your payment at any time via bill pay before the payment is in process. After it is in process you will need to call the bill pay service at 855.837.3991, or contact the Member Solutions Department at 800.252.6950 and we will attempt to cancel the payment or place a stop pay on the check (if applicable).

back to top

You can log in to Online Bill Pay and check the status of payments at any time. If a scheduled payment did not arrive at a biller, you can open a case online to have your payment researched. You can do this by clicking on Bill history, then 'view details' and then 'payment inquiry' inside of Online Bill Pay. You can also call the call center at 855.837.3991 to open a case.

back to top

Your checking account balance will no longer be displayed in Online Bill Pay. However, you can open the Online Banking summary page and Online Bill Pay in separate windows and set them side by side, or you can toggle in between them to see your checking balance and the Online Bill Pay window at the same time.

Online Banking Bill Pay Support. For questions relating to payments made through Online Bill pay please call our Bill Pay support number at 855.837.3991.

Popmoney is a registered trademark of Fiserv, Inc.

back to top

In order to access CU1 Mobile Banking, you need a Credit Union 1 account, access to Online Banking, and a mobile device with an Internet connection.

back to top

You can access CU1 Mobile Banking from any Internet-enabled mobile phone, iPhone®, iPad®, or Android® device.

Note: For the mobile app, devices must be Internet-enabled and have a cell phone number associated with them. The tablet app is currently for iPad® only.

back to top

CU1 Mobile Banking is encrypted using the Wireless Transport Layer Security (WTLS) protocol, which provides the highest level of security available today. Additionally, all data that passes between web servers are encrypted using the Secure Socket Layer (SSL) technology.

back to top

No. CU1 Mobile Banking is a benefit of CU1 membership and is a complimentary service. Message and data rates charged by your carrier may apply.

back to top

To reset your password, choose the "Forgot Password?" option from the login screen and reset your password.

To reset your User ID, go to the Online Banking login through your mobile device's browser, and select the "Forgot User ID?" option.

You may also call our Member Solutions Team at 800.252.6950.

back to top

Some carriers may block access to text messages from Credit Union 1. Please contact your carrier if you receive a message that texts are blocked or if you have issues receiving texts from Mobile Banking.

back to top

Mobile Deposit is a secure and convenient way of making deposits with your mobile device anytime, anywhere! Take photos of the front and back of your check and submit. Review the deposit and done!

back to top

You can deposit into any of your Savings, Checking or Money Market Account. You can transfer funds from any of these accounts after funds are made available to you, using Online/Mobile Banking.

back to top

The maximum amount per item deposited per day is $2,500 if your account has been opened for 180 days or less or $5,000 if your account has been opened more than 180 days.

back to top

Yes, endorse or sign the check with your signature and your account number.

back to top

On weekdays (excluding holidays), the cutoff time for same business day posting is 4:00PM Central Time. Deposits made after the 4:00PM Central Time cutoff will be posted the next business day. Deposits received after 4:00PM Central Time on Friday or on Saturday or Sunday or any holiday, will be posted on the next business day. Posting usually occurs between 4:00PM and 5:00PM Central Time. Up to $200 of your deposit will be available the following business day. The remainder may be placed on hold up to 2 business days. Longer holds in certain situations may apply.

Mobile Banking Support. For questions relating to signing up, accessing or using the Mobile Banking services please call our Mobile Banking support number at 800.252.6950 and a Member Solutions Specialist will assist you.

Apple, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. Android is a trademark of Google LLC.

back to top

With Online Banking you can review transaction history, make account transfers, pay bills or access your account on your mobile device. Online Banking gives you access to your account where you need it when you need it.

back to top

Online Banking is a free service associated with your Credit Union 1 account. Some fees may apply to services accessed within the application like Popmoney®.

back to top

- Click the Register link under the login button

- Review and accept the terms of this agreement

- Enter the information in the required fields and follow the screen prompts.

- Account Number, Last Name, email Address, Zip Code, Social Security Number, Birth Date.

back to top

Online Banking is secured using the latest encryption and Internet security technologies. We take your online security very seriously.

back to top

- Click the "Forgot Password?" link under the password field.

- Enter the information for the Required Fields.

- Click Submit and follow the screen prompts.

Online Banking Support. For questions relating to signing up, accessing or using the Online Banking services please call our Member Solutions Department at 800.252.6950 and a Member Solutions Specialist will assist you.

back to top

As a financial institution, for your protection, Credit Union 1 needs to authenticate who we are communicating with online. Entering your Social Security Number is required to confirm we are in fact registering/authenticating you.

back to top

The digital banking system uses the information on your Credit Union 1 account to establish your online account. You need to use the home or work phone number, or email address that is on your account.

For the Identity Verification step, you do have the option to select, "I can't be reached at any of these numbers." and you will be presented wit out-of-wallet questions to answer in place of receiving a text or phone call.

If you need to update your phone number or email address that we have on file, please contact our Member Solutions Team at 800.252.6950 to get that updated.

back to top

Your last name needs to be entered exactly as it is on your Credit Union 1 account. Please refer to your statement to confirm.

When you receive the Error Message, you can use the "Forgot Password?" option with your User ID. Follow the screen prompts and answer the questions presented. If you continue to receive an error, call our Member Solutions Team at 800.252.6950.

back to top

Linked Profiles. If you are an owner on another Credit Union 1 account and would like to link your profiles so you can manage both accounts digitally through one login, call our Member Solutions Team at 800.252.6950 and request to Link Profiles.

back to top

Unlinked Accounts. Add unlinked accounts to enable you to transfer funds with other Credit Union 1 accounts online. This would be used to transfer funds from your CU1 account to another person's CU1 account (ie: friend, co-worker, family member etc.) on which you are not an owner.

To setup your unlinked accounts, you must be logged in through a web browser (not the mobile app). Click the Transfers dropdown menu and select Unlinked Accounts. After you provide the information, the designated account will be added to your list of destination accounts on the Manage Transfer screen.

Note: The format to add an Unlinked Account is Account=sfx. Money can only be sent to Unlinked Accounts, you cannot request funds with this feature.

back to top

Receive and view all of your documents electronically! You will get a notification that a document is available for viewing. Simply login to Digital Banking and choose Electronic Documents from the Accounts menu.

back to top

When logged in, send a secure message requesting a Cashier's Check. Go to the Profile Menu, select Messages, and click Compose New in the top right corner of the screen. Complete the form and click Send.

back to top

It is easy to change your User ID! Once logged in, go to the Profile menu, select Profile Update, and click Change User ID. Voila!

back to top

Fast Balances is a feature that lets you get a quick look at your balances from the login screen on your mobile device.

To setup Fast Balances, login and go to the Profile menu, select Profile Update, and click Manage Fast Balances. Turn Fast Balances on, and select your accounts. Voila!

back to top

In the Account Summary screen, click on the Certificate Name and additional account details will appear such as: interest rate, Year to Date Interest, and Maturity Date.

back to top

When logged in, simply go to the Transfers menu and click on Manage Transfers. Pick your source, destination, amount, start date and frequency. That's it! Set it up once and don't worry about it anymore.

back to top

Viewing eStatements on mobile devices is a feature that will be available 1Q 2020.

back to top

The CU1 Mobile Banking app is supported by the most recent versions of iOS and Android. For security purposes, we recommend regularly updating your phone to the latest version of iOS or Android when prompted.

back to top

Text Banking is an easy, fast and secure way of banking while using the texting capabilities of your mobile phone. With Text Banking, you can find out the balance and transactions of your accounts on the go, just by texting.

back to top

You will need to enroll in Text Banking via either Online (desktop) or via the mobile (browser or app). For desktop, go to the Profile dropdown, select Profile Updates and choose Text Banking to enroll in Text Banking. You will need a mobile phone with texting capabilities. Standard messaging and data rates may apply.

back to top

The Text Banking is free to enroll and use, however, your mobile wireless carrier may charge you standard data and messaging rates. Please contact your mobile wireless carrier for messaging and data rates.

back to top

Yes, you do need to create short nicknames to use with Text Banking. It is a lot easier to request the balance of a specific account with short nicknames and makes the reply shorter.

back to top

Do I have to text the commands in all CAPS?

No, the commands are not case sensitive. You can text BAL, Bal, or bal which would all mean the balance command.

back to top

We do not transfer any account numbers, password or such sensitive information. The phone is assumed to be secure with the owner and it is the owner's responsibility to lock the phone for privacy. The balance and transaction history being returned from your account will remain in your messaging history until deleted.

back to top

You can remove a phone from Text Banking by two methods:

a) Texting back stop will remove the phone from Text Banking, or

b) From Online (desktop) or from mobile (browser or app), go to the Text Banking screen. Delete the phone number you wish to remove from Text Banking.

Note that you will need to enroll the phone number again the next time you want to use that phone for Text Banking.

If you have questions, please call our Member Solutions Team at 800-252-6950.

back to top

Do not use an envelope for deposits at CU1 deposit-taking ATMs. Our new, high-tech ATMs instantly verify deposits, so envelopes are not necessary. Deposit cash and checks directly into the machine in stacks of 30. The on-screen instructions will guide you through the deposit process.

back to top

You can deposit up to 30 items (cash and checks) at one time. Cash may be facing any direction but must be unfolded lying flat. Checks must be oriented correctly. There is an infographic on the machine that shows proper orientation.

back to top

Can I deposit cash and checks at the same time?

Cash and checks will need to be deposited as separate transactions. Only one type can be deposited at a time. Our high-tech ATMs will automatically count the deposit. It has an option to display check images on the screen before accepting the amount for deposit. For cash, the machine will calculate the amount you are depositing and displays totals on the screen.

back to top

You do not need to sort cash before inserting it into the ATM; it just needs to be unfolded and lying flat. Our high-tech ATMs will automatically sort and count your cash. Coins are not accepted for deposit. The machine will then calculate the amount you are depositing and display it on the screen.

back to top

Yes. There is an option to display check images onscreen for your instant verification. For cash deposits, you will see a total amount. Your receipt will include an itemized listing of all deposited cash, plus images of deposited check(s).

back to top

Cash deposits are available for use immediately.

Check deposits still fall under Credit Union 1 Funds Availability Policy. Check deposits made on weekdays (excluding holidays) by 4:00 PM CST are considered received on the same day. If made on a holiday or weekend, the check deposit will be considered received the next business day. Items $500.01 or greater – the earliest availability for withdrawal of funds will be the 2nd business day after the business day on which we receive the deposit. Payee must be on the account, or the check will be rejected.

back to top

Yes, you can tap the cancel button on the keypad at any time or during the transaction there will be an option on the screen to cancel the transaction. The ATM will return your cash or check(s) to you.

back to top

The ATM will deposit the entire amount into one account. You can achieve the same goal by then performing transfers between your accounts.

back to top

No. CU1 Card Keeper is included with your checking accounts.

back to top

Yes, you can unsubscribe through the CU1 Card Keeper App via Manage Portfolio. To unsubscribe, uncheck all cards and accounts and tap OK. Or call Credit Union 1 at 800.252.6950. Please note, when unsubscribing from CU1 Card Keeper, all previously set alerts and controls are no longer in effect.

back to top

Yes. To activate an unsubscribed user, you will register as a new user. You are required to select a new username; if you enter your previous username an error displays. Upon successful registration, you may once again use CU1 Card Keeper.

back to top

The app automatically logs the user off after 10 minutes of inactivity.

back to top

Yes. Cardholders can register multiple Credit Union 1 cards within a single CU1 Card Keeper app.

back to top

There is no limit.

back to top

If the card number is new, then yes, you must add the new card number to your profile. You may also unmanage the old card by accessing Manage Portfolio.

back to top

The My Location controls and alerts will check to ensure the merchant location is within a 5-mile radius of the device set as primary within CU1 Card Keeper. These controls impact card present transactions only, therefore internet transactions are not impacted.

back to top

CU1 Card Keeper ignores location information that is more than 8 hours old. So, if the phone is off for more than 8 hours, My Location controls will not take effect, and the transaction will not be denied on the basis of the old location information.

back to top

CU1 Card Keeper performs a proximity check at the granularity of Zip code or city, so if the merchant is close to home then the transactions will still go through.

back to top

The region shows the approximate area where the card can be used; the area must be greater than 5 square miles. CU1 Card Keeper can typically map the transaction down to a ZIP code or city. If the city or ZIP code of the merchant overlaps with the selected region in the map, then the transaction can still go through. There are instances where a merchant location cannot be mapped down to a ZIP code or city, in which case CU1 Card Keeper will default to a state-level match.

back to top

Yes. International transactions can be blocked using the Block International location control. Transactions will be limited to the United States.

back to top

No. The location controls are applicable to in-store transactions only.

back to top

Previously authorized recurrent payments will continue to process and will bypass the CU1 Card Keeper edit checks.

back to top

CU1 Card Keeper alerts are sent as push notifications to the phone. The alerts also display under Messages in the CU1 Card Keeper app.

Message and data rates may apply. Check with your mobile carrier for details. The iPhone and App Store are trademarks of Apple Inc., registered in the U.S. and other countries. Android and the Google Play logo are trademarks of Google LLC.

back to top

Yes, the app shows the last 50 card-based transactions posted within the last 30 days.

back to top

Android Device Users: Uninstall the old CU1 Mobile Banking App and CLICK HERE to install the NEW CU1 Mobile Banking App. We are working with Google to get the updated app to appear directly in Google Play.

Apple Device Users: Go to the App Store and Update your CU1 Mobile Banking App

Online Users: Go to creditunion1.org and click the Login button in the page header.

EXISTING Digital Banking Users: you will use your existing login credentials to login to the NEW system for the first time. Then, follow the screen prompts to setup your new digital banking experience.

NEW Digital Banking Users: Register on our website first. Once registered, you can download the CU1 Mobile App and login to digital banking. We are working on an update to be able to register using the mobile app.

NOTE: If you become locked out of digital banking, click “Forgot Password”, and follow the prompts.

back to top

Android: Uninstall the old CU1 Mobile Banking App and CLICK HERE to install the NEW CU1 Mobile Banking App. We are working with Google to get the updated app to appear directly in Google Play.

Apple: Go to the App Store and update your CU1 Mobile Banking App.

back to top

eStatements are now available in digital banking. Please login to your digital banking and select Statements under the Services Tab.

back to top

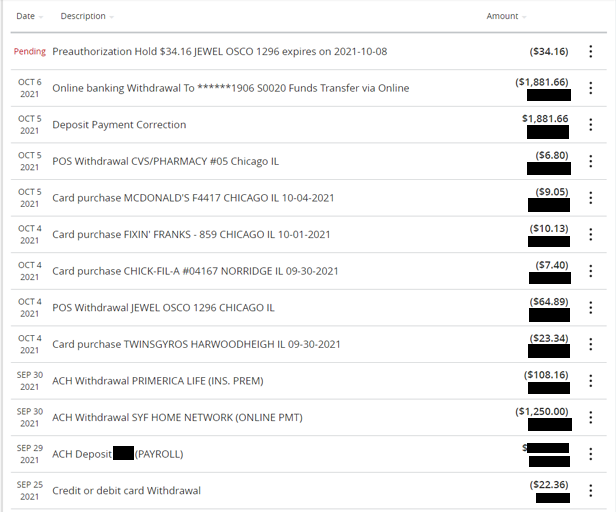

When you are logged in to digital banking, tap or click the account tile and your transaction history will appear.

back to top

Once you login for the first time, it can take several minutes for account history to appear. We are finding history appears after approximately 15 minutes. After waiting, If you are still unable to view history, contact Credit Union 1 at 800.252.6950 or start a Live Chat session with our Member Solutions Team at creditunion1.org.

back to top

We are aware of this hiccup and are diligently working on a solution that will allow members to view Trust Account Information soon.

back to top

If you do not make your CU1 mortgage payment before the due date, contractually the payment is late. But don't worry, you have a 15 day grace period before a late fee is charged.

back to top

Our new system is personcentric meaning everything is organized by the individual. Members can only view/access accounts and loans they are signers on. Our old system was accountcentric meaning everything was organized by account number. Moving to a personcentric system provides greater fraud protection.

back to top

We are aware of this hiccup and are diligently working on a solution to resolve this issue as soon as possible. A late fee has not been assessed.

back to top

We were able to convert 18 months of transaction history to the new digital banking system. The details were not comparable on both systems so history prior to October 1, 2021 is generic. As you perform transactions from October 1, 2021 forward, details will appear.

For detailed transaction history prior to October 1, 2021, refer to your statements.

back to top

We have discovered that members who are joint on a credit card are not able to see the credit card in digital banking. Credit card visibility is a high priority and we are working on a solution that will be available soon.

back to top