Construction of Corporate Headquarters in Rantoul, IL in 1976.

Change is a part of growth and becoming better, and Credit Union 1 has continued to evolve and grow since we were founded in 1958 with an original base of membership of personnel from Chanute Air Force Base in Rantoul, Illinois. Since then we have grown tremendously into a Billion dollar plus financial institution, but our core values remain the same. Be Great, Be Engaged, Be Open, and Be Nice. These core values drive our mission statement “To be THE financial institution that drives family and community success.”

CU1’s history demonstrates our ability to adapt and become a stronger organization through transformations like in 1978 when it was announced that Chanute Air Force Base, the original source of membership, was a candidate for closure. After the decision to retain Chanute Air Force Base was made, it was apparent CU1 needed a strategy to grow other areas of membership to insulate the credit union from being at this type of risk in the future.

Over the next 20 years CU1 offered smaller credit unions more financial strength via merger, while at the same time increasing CU1 field of membership options. One very notable change was transitioning the Credit Union 1 field of membership from “occupational” to “associational” so that CU1's field of membership was no longer restricted to military affiliations.

Since the transition, Credit Union 1 has continued to grow by making itself available to anyone that wishes to be a part of the Credit Union movement via our 250+ Select Employment Groups (SEGs) as well as our CU1 Educational Development Association (CU1EDA) that allows members to join via a $5 donation to the CU1EDA. CU1 is continually looking to help current and future CU1 members maximize their economic potential through outstanding products, technology, service, and diversity of serving new communities.

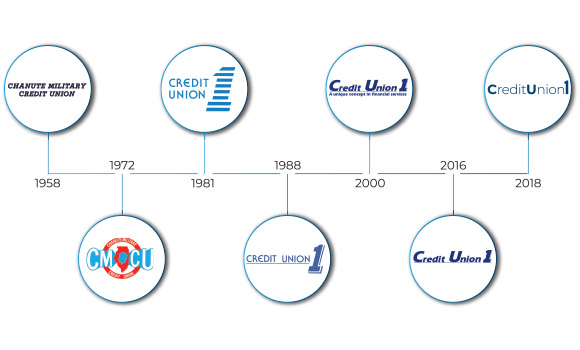

Evolution of our logo